Micro Bitcoin Futures

Contract Specifications CONTRACT SIZE 0.10 bitcoin TRADING HOURS CME Globex: Sunday – Friday 6:00 p.m. – 5:00 p.m. ET (5:00 p.m. – 4:00 p.m. CT) with a 60-minute break each day beginning at 5:00 p.m. ET (4:00 p.m. CT) CME ClearPort: 6:00 p.m. Sunday to 6:45 p.m. Friday ET (5:00 p.m. – 5:45 p.m. CT) with […]

Trading Venues (Pit vs. Online)

Understanding Trading Venues The futures market is a dynamic marketplace that currently conducts business via the trading floor or electronic trading. While trading has shifted to mostly electronic transactions, the trading pit still exists and maintains relevance in today’s marketplace. Trading Floor Historically, all futures business was transacted on the trading floor. The trading floor […]

Understanding the Role of Hedgers

What is a Hedger? Hedgers are primary participants in the futures markets. A hedger is any individual or firm that buys or sells the actual physical commodity. Many hedgers are producers, wholesalers, retailers or manufacturers and they are affected by changes in commodity prices, exchange rates, and interest rates. Changes to any of these variables […]

Understanding the Role of Speculators

What Are Speculators? Speculators are primary participants in the futures market. A speculator is any individual or firm that accepts risk in order to make a profit. Speculators can achieve these profits by buying low and selling high. But in the case of the futures market, they could just as easily sell first and later […]

Calculating Futures Contract Profit or Loss

Market participants trade in the futures market to make a profit or hedge against losses. Each market calculates movement of price and size differently, and as such, traders need to be aware of how the market you are trading calculates profit and loss. To determine the profit and loss for each contract, you will need […]

Price Discovery

Price discovery refers to the act of determining a common price for an asset. It occurs every time a seller and buyer interact in a regulated exchange. Because of the efficiency of the futures markets and the ability for the instant dissemination of information, bid and ask prices are available to all participants and are […]

Understanding Futures Expiration & Contract Roll

The Lifespan of a Futures Contract Futures contracts have a limited lifespan that will influence the outcome of your trades and exit strategy. The two most important expiration terms are expiration and rollover. Contract Expiration Options A contract’s expiration date is the last day you can trade that contract. This typically occurs on the third […]

Margin: Know What’s Needed

Understanding Margin Securities margin is the money you borrow as a partial down payment, up to 50% of the purchase price, to buy and own a stock, bond, or ETF. This practice is often referred to as buying on margin. Futures margin is the amount of money that you must deposit and keep on hand […]

Mark-to-Market

What is Mark-to-Market? One of the defining features of the futures markets is daily mark-to-market (MTM) prices on all contracts. The final daily settlement price for futures is the same for everyone. MTM was a distinctive difference between futures and forwards until the regulatory reform enacted after the financial crises of 2007-2008. Prior to those […]

About Contract Notional Value

Contract Unit The contract unit is a standardized size unique to each futures contract and can be based on volume, weight, or a financial measurement, depending on the contract and the underlying product or market. For example, a single COMEX Gold contract unit (GC) is 100 troy ounces, which is measured by weight. A NYMEX […]

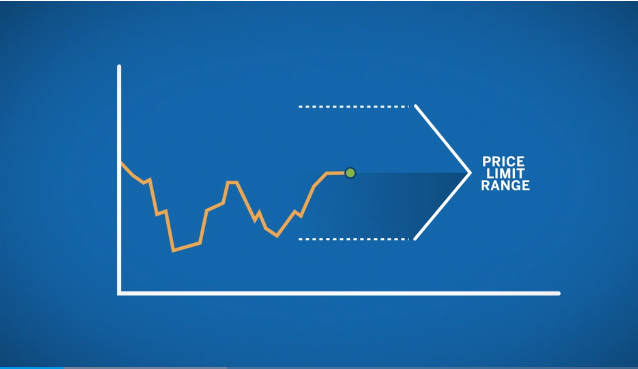

What are Price Limits and Price Banding?

As a trader, you want to know that there are mechanisms in place to ensure an orderly market. A regulated marketplace like CME Group provides this order by setting price limits and price banding. Price Limits Price limits are the maximum price range permitted for a futures contract in each trading session. These price limits […]

Tick Movements: Understanding How They Work

Minimum Price Fluctuation All futures contracts have a minimum price fluctuation also known as a tick. Tick sizes are set by the exchange and vary by contract instrument. E-min S&P 500 tick For example, the tick size of an E-Mini S&P 500 Futures Contract is equal to one quarter of an index point. Since an […]

Get to Know Futures Expiration and Settlement

Overview of Expiration and Settlement Expiration All futures contracts have a specified date on which they expire. Prior to the expiration date, traders have a number of options to either close out or extend their open positions without holding the trade to expiration, but some traders will choose to hold the contract and go to […]

Understanding Contract Trading Codes

What are Trading Codes? The display format of futures contract codes is fundamental to understanding pricing across multiple expirations. Contract display codes are typically one- to three-letter codes identifying the product followed by additional characters indicating the month and year of expiration. The format of a contract code varies according to the asset class and […]

Learn About Contract Specifications

Every futures contract has an underlying asset, the quantity of the asset, delivery location, and delivery date. For example, if the underlying asset is light sweet crude oil, the quantity is 1,000 barrels, the delivery location is the Henry Hub in Erath, Louisiana and the delivery date is December 2017. When a party enters into […]

Fireside Chat with Anthony’s Mentor, Dr. Mickey Hoffman

What’s up traders! In this video I chatted with one of my first mentors, Mickey Hoffman. I met Mickey in 1995 when I was a runner on the floor of the Chicago Mercantile Exchange. Mickey’s story is incredible! He shares with us how a street fight was the pathway to him getting his start on […]

Best Books on Futures Trading

There are many benefits of futures trading, but it’s not something you should dive into without a high level of knowledge and understanding of the markets. While there’s no shortage of websites, blogs, and online resources, don’t rely solely on the internet to guide your investing decisions. Instead, you should also read as many books […]

The Basics of Futures Trading

Are you interested in Futures Trading? If so, start by learning the basic definition of futures as shared by Investopedia: Futures are derivative financial contracts that obligate the parties to transact an asset at a predetermined future date and price. Here, the buyer must purchase or the seller must sell the underlying asset at the […]